Insights

21

2025

-

06

Catering Enterprises' Southeast Asia Expansion — "An Opportunity Firmly Grasped"

Author:

Release time:

2025-06-21

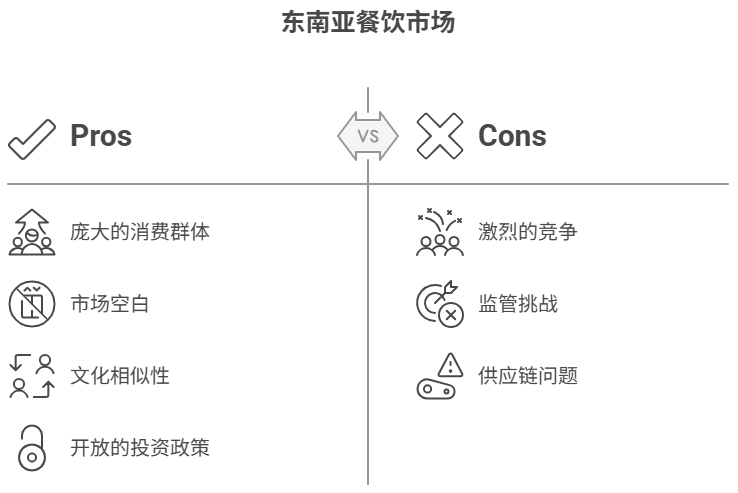

- Large consumer groups

- Market gaps

- Cultural similarity

- Open investment policies

- Fierce competition

- Regulatory challenges

- Supply chain issues

- Mixue Ice Cream & Tea has quickly established itself in Southeast Asia with cost-effective products and a robust supply chain.

- Naixue's Tea caters to local consumers' pursuit of quality life through its premium tea positioning.

- Luckin Coffee accelerates store layout in Southeast Asia by leveraging digital operations.

- Cha Baidao actively expands via unique product flavors and marketing strategies.

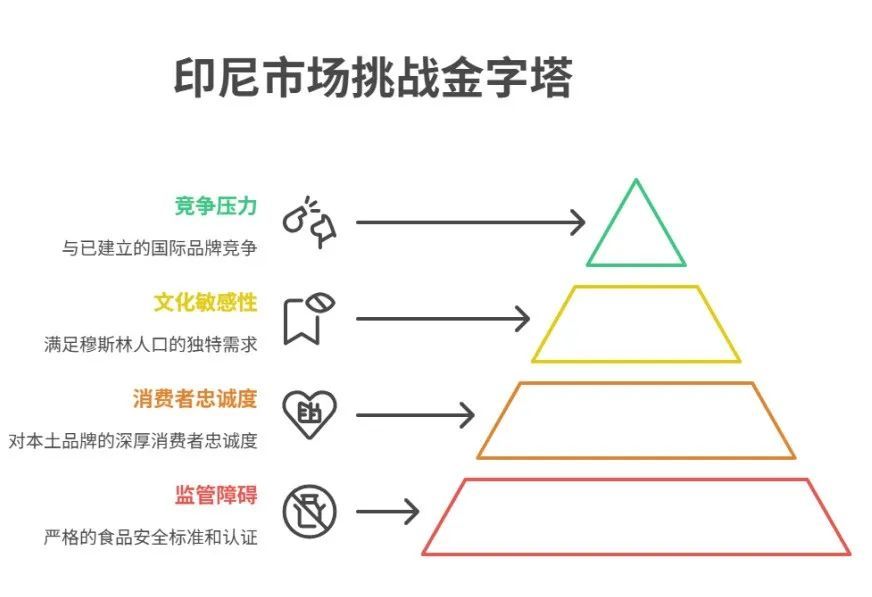

- Strict regulations and high food safety standards in Australia, Japan, and South Korea, combined with strong local brand loyalty, hinder Chinese enterprises’ penetration.

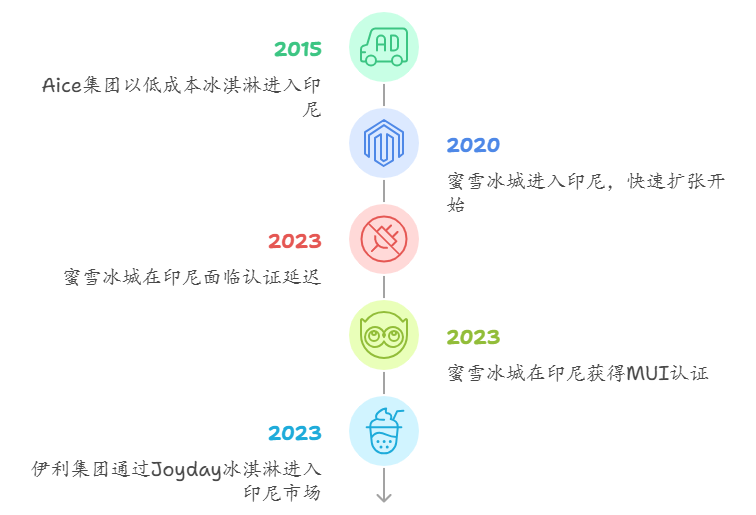

- In Indonesia, the world’s most populous Muslim country, brands face unique challenges. Mixue triggered protests in 2023 due to delayed Islamic council certification but eventually obtained approval from the Indonesian Ulema Council (MUI) after proactive communication.

- Aice Group, a Singaporean-Chinese brand entering Indonesia in 2015, won market trust with low-cost ice cream tailored to local tastes, growing into a large catering enterprise with 3 factories by 2022.

- China’s Yili Group enters via its Joyday ice cream brand, competing directly with Aice and Mixue.

Related News

undefined

Immediate consultation

If you are interested in our products, please leave your contact information, we will contact you as soon as possible, thank you!

COOKIES

Our website uses cookies and similar technologies to personalize the advertising shown to you and to help you get the best experience on our website. For more information, see our Privacy & Cookie Policy

COOKIES

Our website uses cookies and similar technologies to personalize the advertising shown to you and to help you get the best experience on our website. For more information, see our Privacy & Cookie Policy

These cookies are necessary for basic functions such as payment. Standard cookies cannot be turned off and do not store any of your information.

These cookies collect information, such as how many people are using our site or which pages are popular, to help us improve the customer experience. Turning these cookies off will mean we can't collect information to improve your experience.

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third-party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

These cookies help us understand what you are interested in so that we can show you relevant advertising on other websites. Turning these cookies off will mean we are unable to show you any personalized advertising.

2024 BECY INTERNATIONAL ENTERPRISE SERVICES (SHENZHEN) CO., LTD

Website Construction: China Enterprise Power Shenzhen SEO